Limitless Pools

Limitless Pools are a novel new primitive underpinning Blackwing's margin trading - enabling liquidation free leverage on any asset.

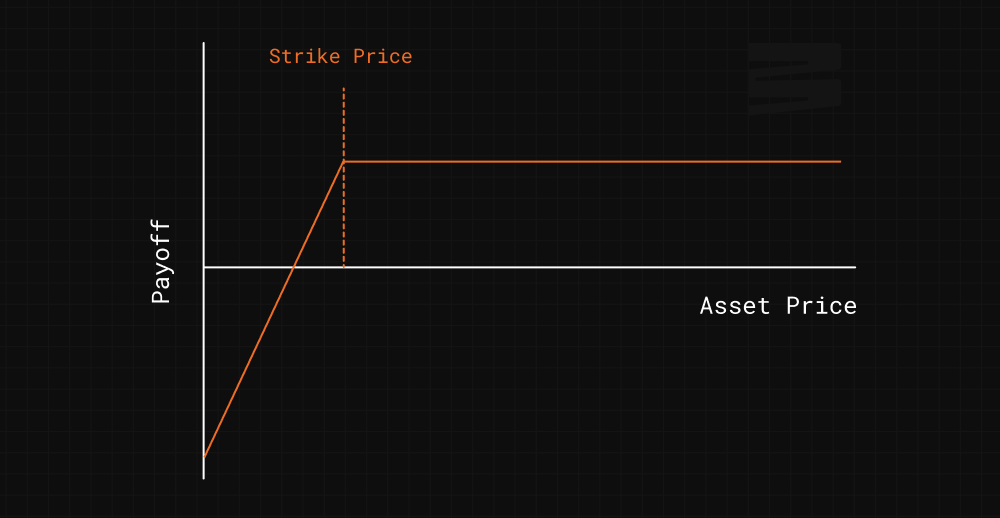

Limitless Pools rely on the key insight that existing CLMM and AMM positions have similar payoffs to cash-secured put or covered call option strategies.

Similar to how multiple option contracts can be combined to form different strategies, Blackwing converts LP positions into structures called Domains which ensure that the original LP position can be recreated regardless of the price of the original asset.

LP Position Payoffs

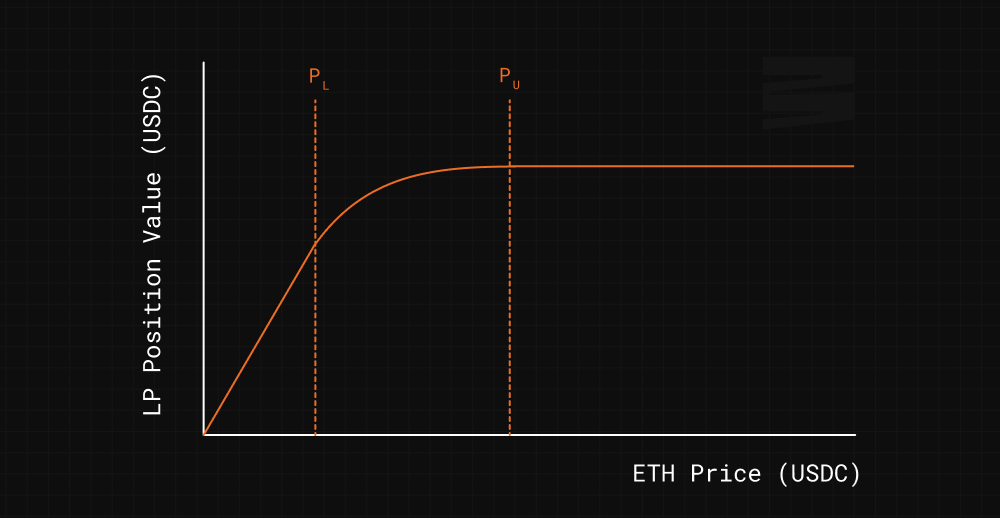

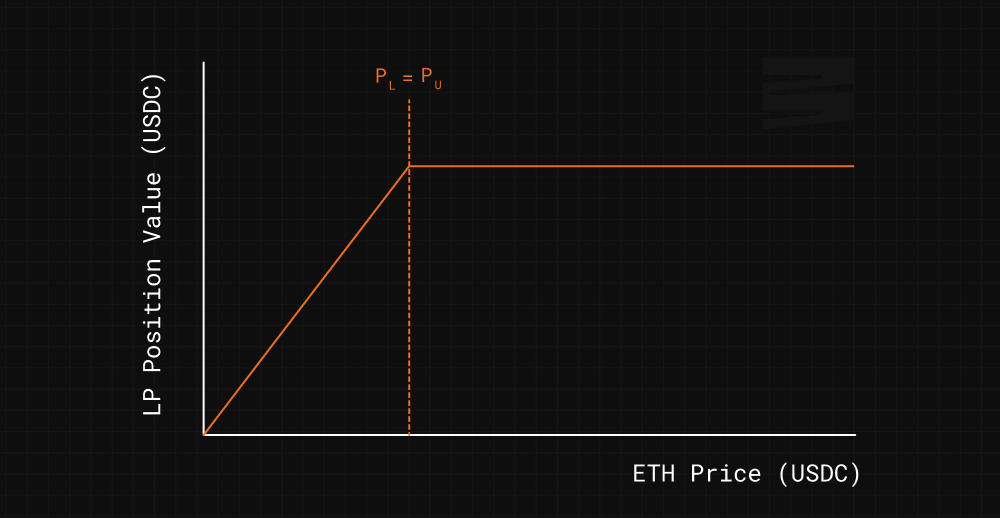

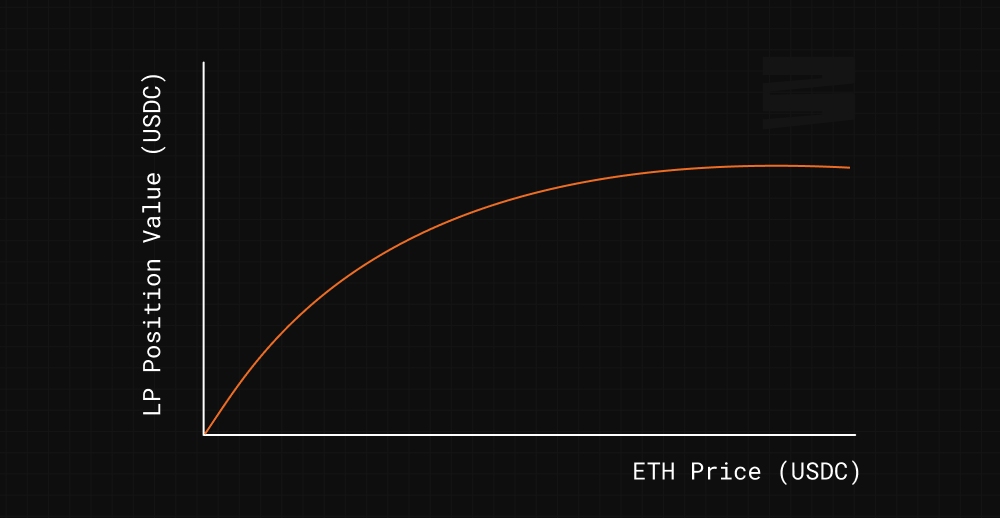

Depending on which type of pool an LP is providing liquidity to, we can construct a graph modeling the position's value as a function of the underlying asset's price (in terms of the opposite pair asset that the pool is composed of).

For Uniswap V3 positions (CLMM), the LP defines an upper and lower bound. Taking ETH/USDC as an example, if the price is larger than the upper bound, the LP's position is composed entirely of USDC. If the price is less than the lower bound, the LP's position is composed entirely of ETH. In between, the LP's position mimics a constant product curve. So a CLMM LP position is modeled using the following curve.

If we converge the upper and lower bounds to be just one tick apart, we get a curve which looks exactly like the options payoff curve shown above.

If we were to expand the upper and lower bounds so that the lower bound is at 0 and the upper bound is at infinity, we get the payoff curve for a Uniswap v2 (AMM) LP position.

Domains

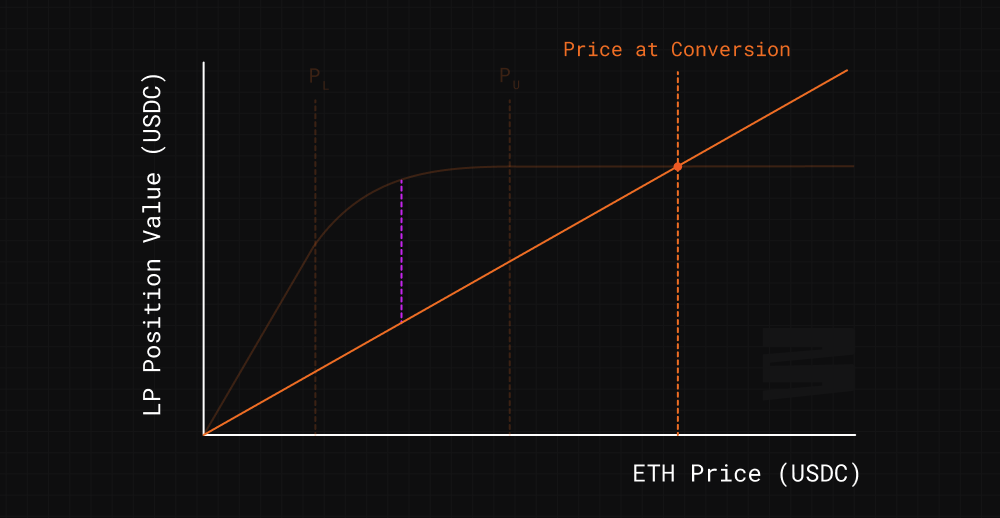

A Domain is a construct that allows the original LP position to be recreated regardless of the price of the original asset. To derive how a Domain can be constructed, let's consider a trader that wants to long ETH and the price of ETH is currently larger than the upper bound of a CLMM LP position being used as liquidity.

At this point, the entirety of the LP position is USDC. Let's say we converted the position to ETH at the current price (ignoring any slippage and trading fees). We can then graph the converted position's value as a function of the price of ETH.

If the price of ETH increases, the value of the converted position will be greater than the value of the LP position. So the converted position can always be converted back into the LP position. If the price of ETH decreases, there is a difference between the value of the original LP position and the converted position. The difference reaches a maximum (highlighted above in purple) somewhere between the upper and lower bounds (the exact point depends on CLMM implementation).

The maximum difference is the amount of collateral that the user needs to provide. The collateral is converted to USDC and, along with the converted ETH, forms the Domain. No matter the price of ETH, the contents of the Domain can always be converted back into the original LP position.

Similar logic is used to construct Domains for different curves, different price points, and for short positions. Note that for short positions, the market price must be below the lower bound of the LP position (as a corollary, AMM LP positions can't be used to facilitate shorts).

Domain Premiums

Traders pay premiums to LPs to open Limitless Pool Domains. Premiums for keeping a position open for 7 days are collected upfront. If the Domain is deconstructed before the 7 days, the trader is refunded premium for the remaining days on a prorated basis. Before the 7 days are over, the trader has the option of paying premium for an additional 7 days to extend the Domain.

Benefits for LPs

Limitless Pools allow existing AMM/CLMM LP positions to be used as liquidity for margin trading. Rather than remove the LP position from the original AMM/CLMM pool it remains there and continues to earn trading fees. The original LP position is only removed when being converted into a Domain, at which point it earns additional fees via the trade premium.